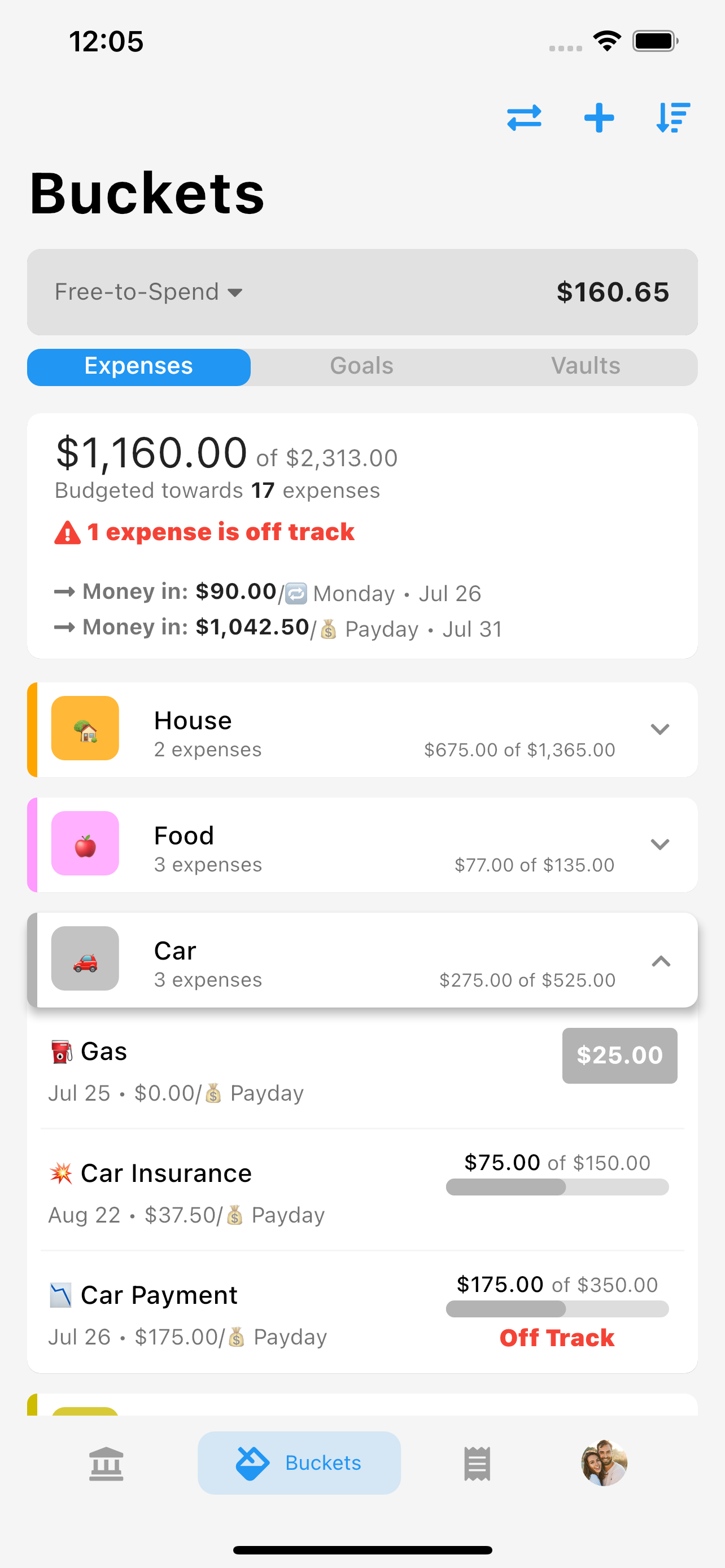

DAS Budget builds on the concept that budgeting doesn't need to be complex. Simply create your expenses for the month, associate a funding schedule (every payday, for example) and it automatically handles funding for your bills. Each budget is linked to a spending category where any transaction with that category will automatically spend from that bucket. Categories include rent, groceries, fast food, auto insurance, gas, investments, credit card payments, shopping, pet supplies and many more!

Free-to-Spend is the concept of knowing how much money you can safely spend without dipping into your expense or goal money. This Free-to-Spend number is automatically calculated each time the app is opened to give you the most up-to-date amount and allow you to confidently make purchases.

Buckets

Expenses

Expense buckets are awesome for recurring fixed expenses. Pick a target amount you need each month (or week, or year, or every two years), tell DAS how often to allocate money toward that expense and enjoy knowing that the money will be set aside, ready when you need it.

Goals

Goal buckets are similar to Expenses but Goals are oriented for single-use or mid-long range needs. Pick a target amount and a funding schedule. Let DAS worry about the details of allocating the money into your goal. Both Expenses and Goals are buckets backed by your checking account(s).

Vaults

Vault buckets are backed by your savings account(s) and have the same features as Expenses and Goals. Pick a target balance to save, a date by which you want the money allocated and let DAS figure out the math for you. Vaults are buckets backed by your savings account(s).

Plan for your recurring Expenses like rent, car payments, and phone bills. Automatic Spending automates the tedium out of your budget. Link merchants or even whole categories of spending with your buckets. Got a french fry addiction? Setup a French Fries expense with automatic spending for Fast Food and know that your golden brown and delicious snacks are planned and paid for.

DAS can automatically allocate money into your buckets in two possible modes Set Aside Target Amount for consistent allocation each funding period, or Reach Target Amount to fill the bucket and then pause until the bucket is drawn down by spending.

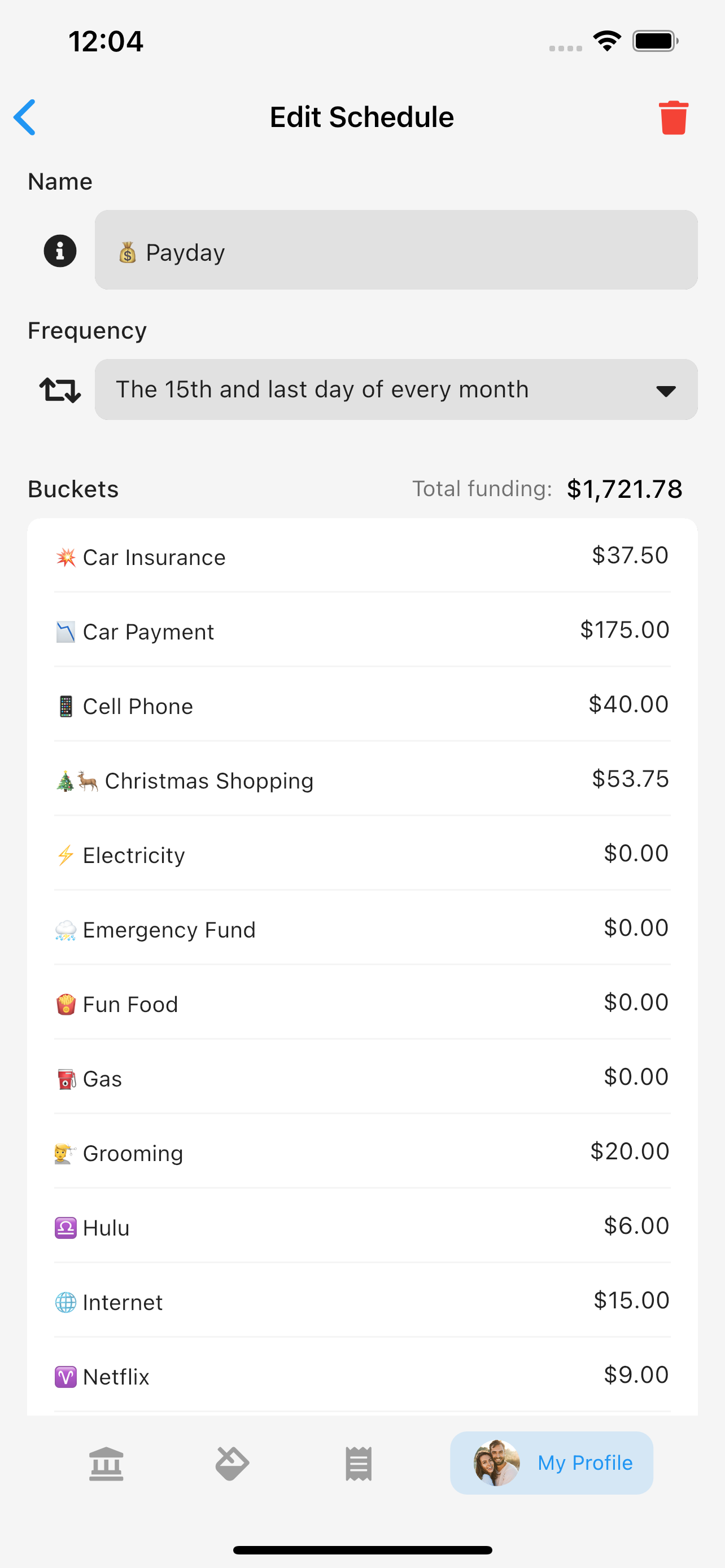

Funding Schedules

DAS helps you earmark (or allocate) money, keeping you ready to meet your financial commitments. By using Funding Schedules to control when money gets allocated into buckets, DAS can help you stay on-track by automatically setting money aside to meet your budget needs.

Setup buckets with automatic funding and pick a funding schedule that makes sense for you. Want to set aside some money each payday? You got it. Maybe you’d rather set aside a few dollar each day? No problem.

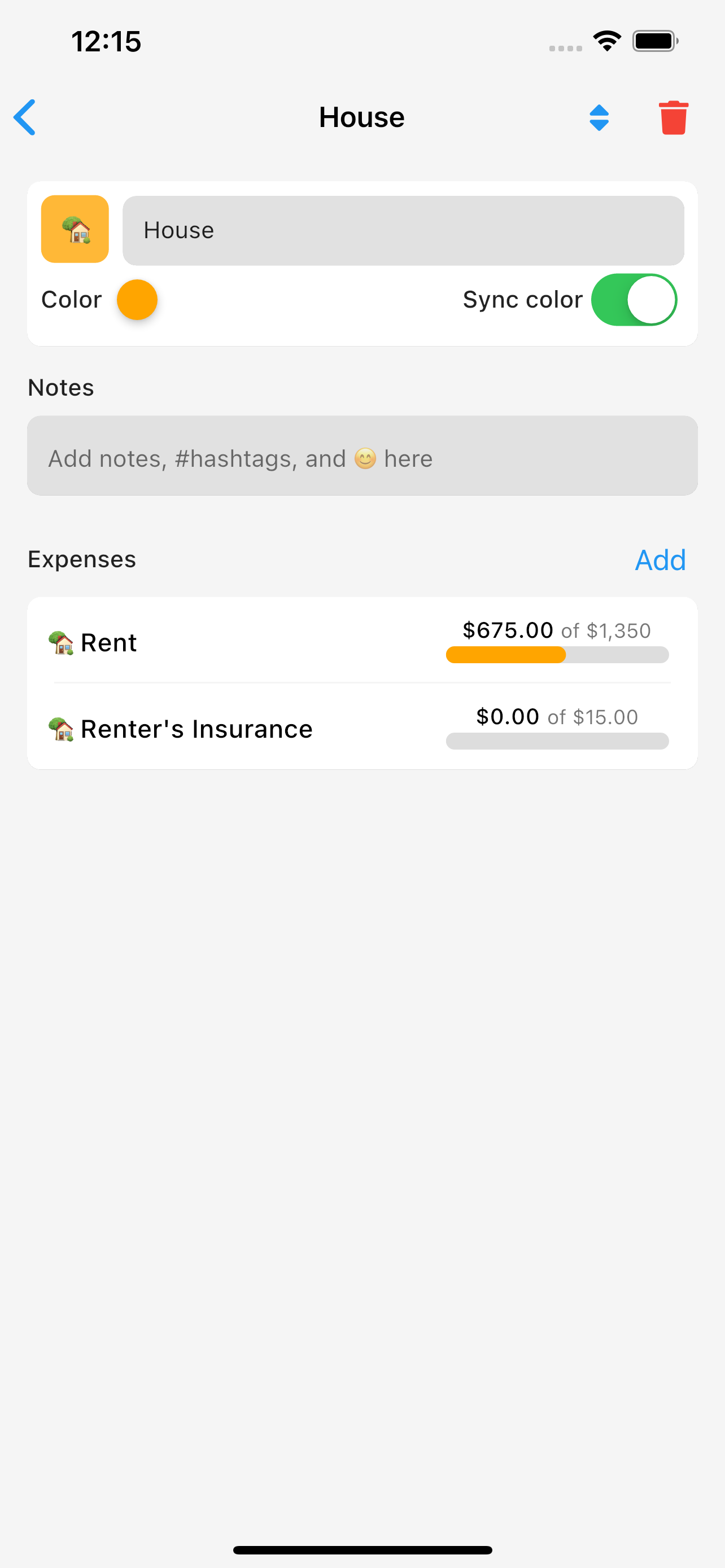

Bucket Groups

Group your expenses and goals together for “at-a-glance” knowledge. Netflix, Hulu, Spotify, and YouTube TV subscriptions all together in your Subscriptions bucket group? DAS can do that! Organize your budget categories in a way that works for you. This breakdown can easily allow you to understand what portion of your budget is going where.

Bucket groups also provides customization for buckets. Having the option to sync a color to all buckets in a group will continue with that effect throughout the app such as the Activity page.

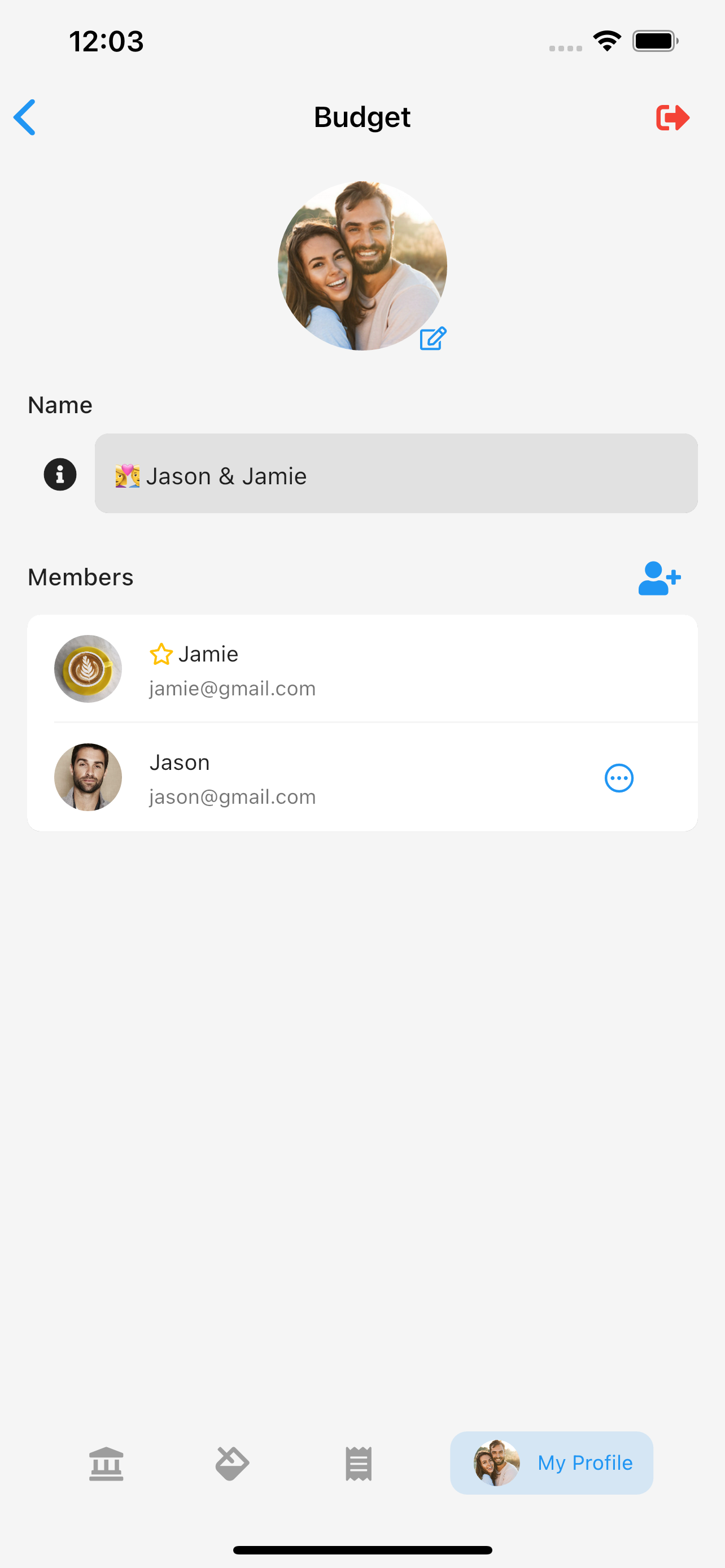

Budgets

Budgets give users a way to keep tabs on multiple aspects of their live.

Have a partner? No, problem add them as a member to your budget for joint budgeting.

Have a business? Create a separate budget and assign your business bank account to your newly created budget.

You can customize your budgets with a name and a custom picture. The budget picture is used in the My Profile tab to always let you know which budget you have selected.

Pro-tip: Long-press the My Profile tab to quickly switch between budgets.

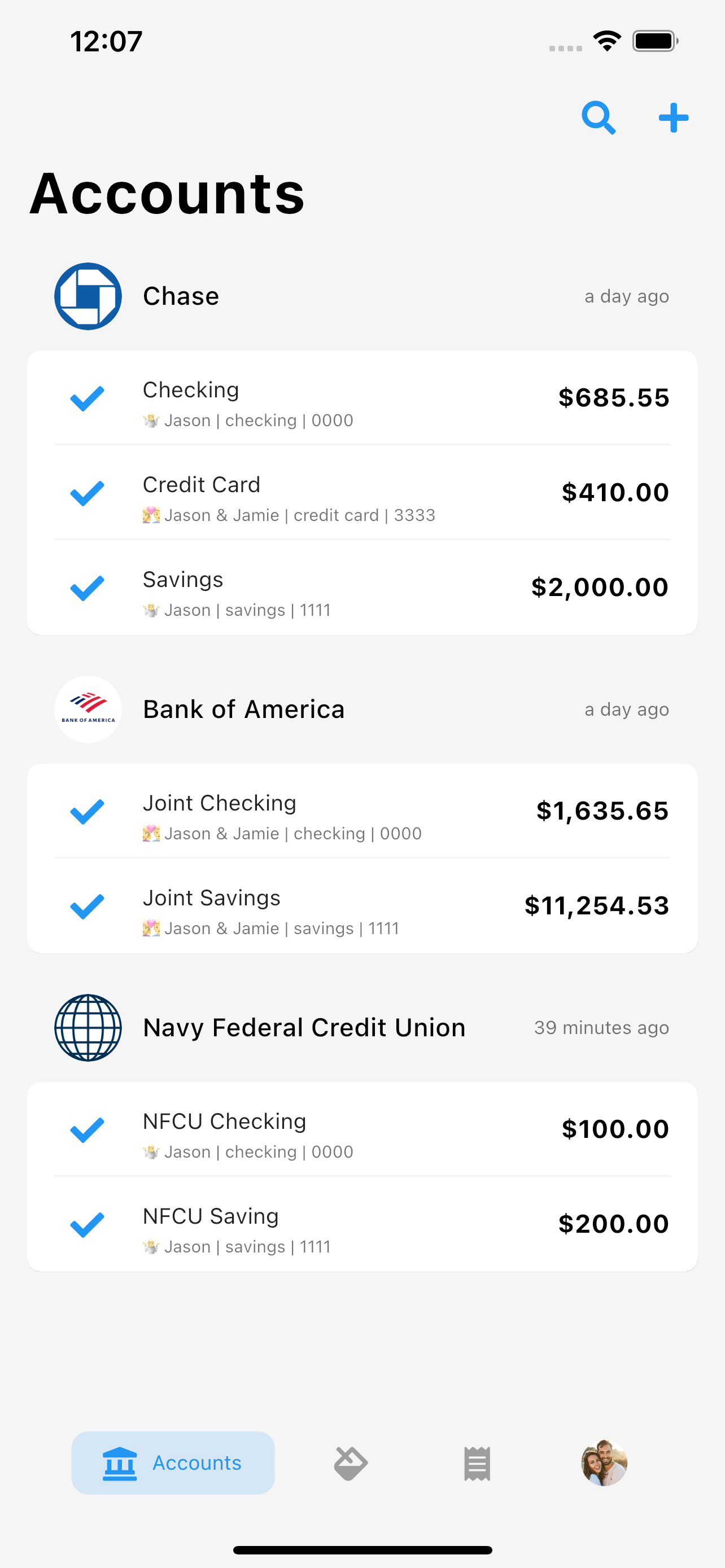

Accounts

DAS Budget allows users to link their bank accounts to take remove any and all manual steps to import transactions. DAS supports Checking, Savings, CD, and Credit Card type of accounts.

The best use of DAS comes when linking multiple bank accounts. Any account marked as active (the blue check icon) will be considered in Free-to-Save and Free-to-Spend calculations. The cummulative total between all accounts is in full effect to accurately view a picture of your finances.

Tapping on your bank's icon will send you into a detail view of your connections health. This view includes the last sync time between DAS to Plaid/MX (DAS' data aggregators) and the last sync time between Plaid/MX and your bank.

Tapping on an individual bank account will grant you options to assign that account to a certain Budget or disable that account from particicapting in cummulative checking/savings amount totals.

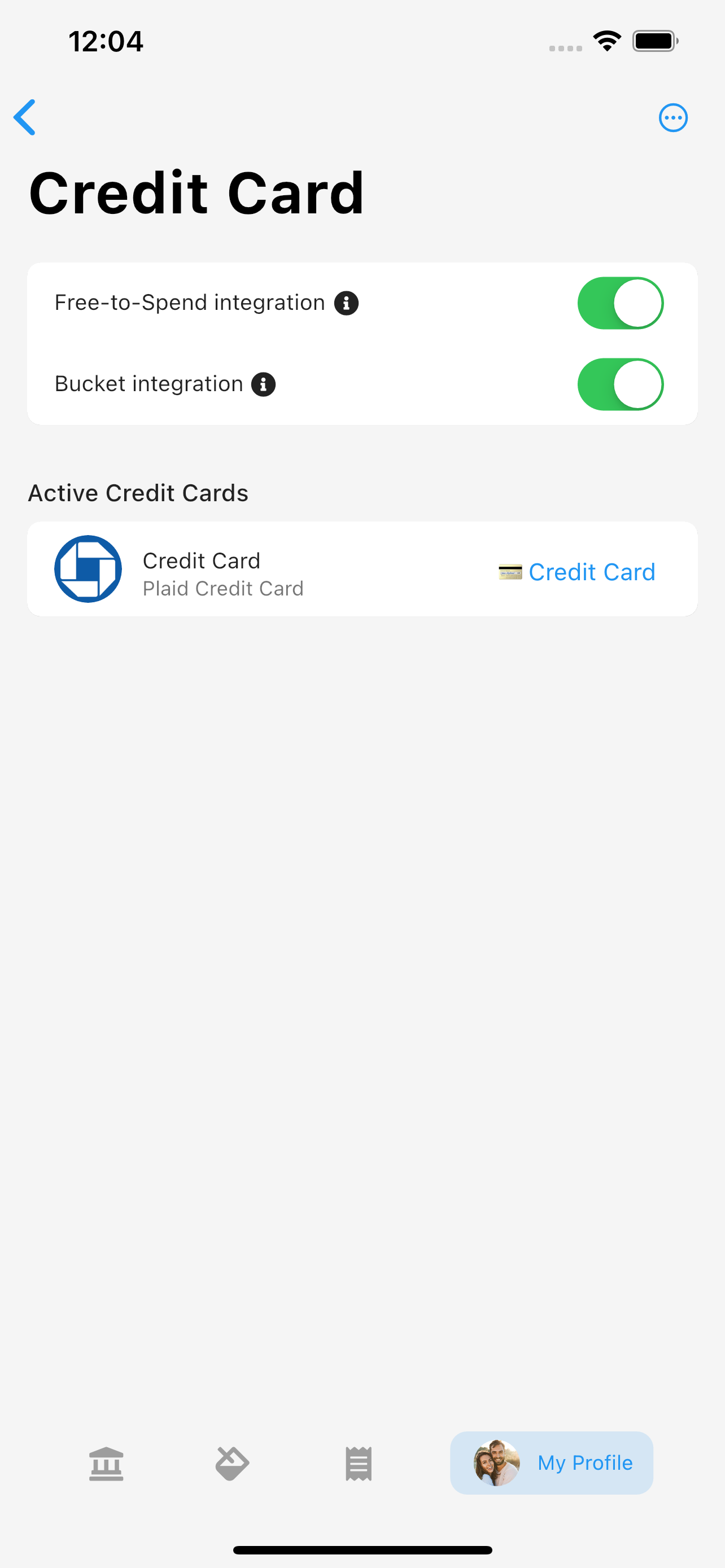

Credit Card Integration

Never get surprised by a credit card bill again – with DAS Budget’s Credit Card integration, you can automatically earmark money with each swipe, tap, or dip. Money will be allocated to pay for each purchase so you’re ready at the end of the month when the statement arrives.

With Free-to-Spend integration turned on, DAS will transfer money from Free-to-Spend to your dedicated credit card expense to pay for what you use.

With Bucket integration turned on, DAS will match and auto-spend credit card purchases to your Buckets. Money spent from the matched Bucket will automatically be spent and transfered to your dedicated credit card expense to cover your end of month bill.

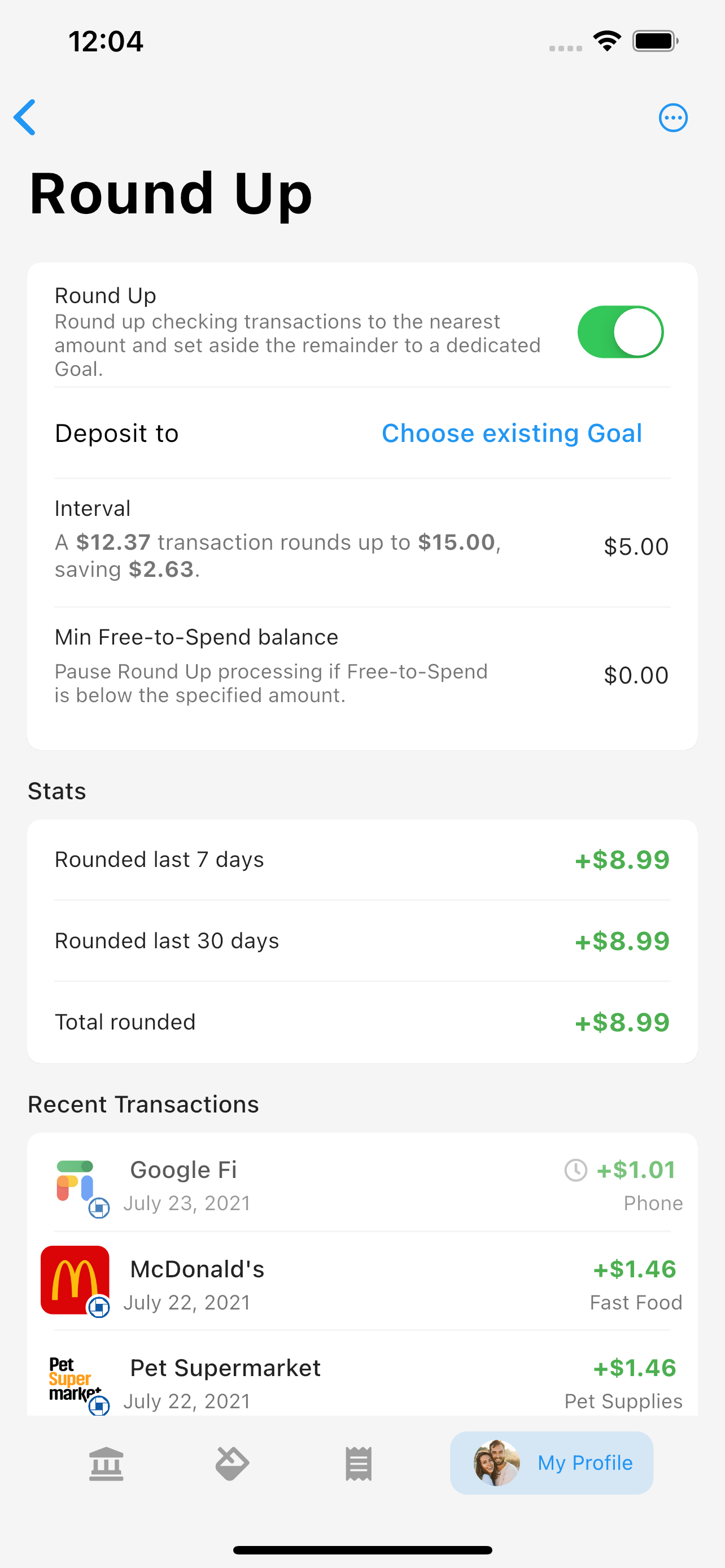

Round-Ups

Round up! Round up your change to super charge your saving efforts or just to top-up your coffee fund. DAS offers powerful customization to choose which Round-Up interval suits you!

Want to take the casual route? Round-Up to the nearest dollar. Living life on the edge? Round your transactions to the next $10 interval!

Sometimes, it's not all fun and games. Round-Ups come with the option to pause all rounding if your Free-to-Spend balance drops below a certain threshold.